On March 11th, the Internal Revenue Service (IRS) announced that high-deductible health plans (HDHPs) can pay first dollar coverage for 2019 Novel Coronavirus (COVID-19)-related testing and treatment, without jeopardizing their status. The IRS is taking these steps due to the nature of this public health emergency, and to avoid administrative delays or financial disincentives that might otherwise impede testing for and treatment of COVID-19 for participants in HDHPs.

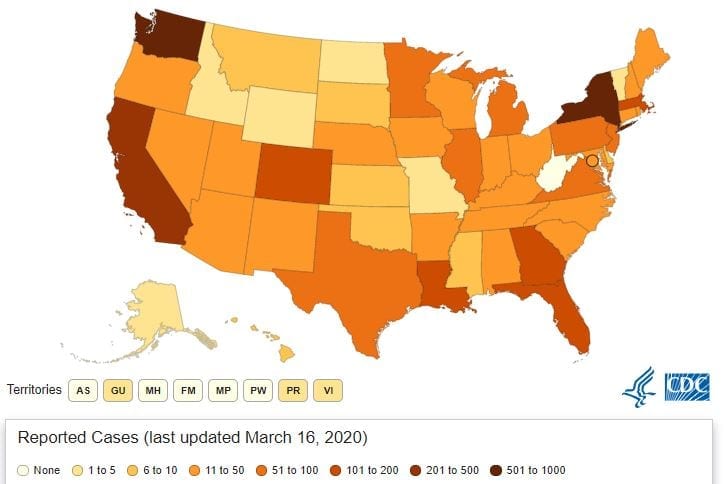

As of March 16th, there are currently 3,487 cases of coronavirus including 68 deaths in the United States (CDC). Crumdale Partners has previously provided recommendations that employers can take to protect their employees during this national emergency. (Found :HERE)

Additional Resources: IRS; CDC